Spencer Stuart’s 2025 MidCap Board Index revealed the following and other key findings for the S&P MidCap 400 based on the firm’s analysis of proxy statements filed between September 6, 2024 and August 21, 2025:

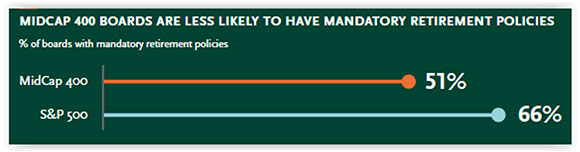

Refreshment tools—Although the average age limits are comparable (~age 74), as compared to the S&P 500, mid-caps are much less likely to have mandatory retirement policies:

The actual average age for both mid-cap and large-cap directors is 63.6.

While tenure limits are generally uncommon across company sizes, they are even less prevalent for mid-caps (7%) than large-caps (10%). Tenure limits, if used, average 14 years for mid-cap directors and 14.7 years for large-cap directors. The actual average tenure is 7.8 years for both mid- and large-cap directors.

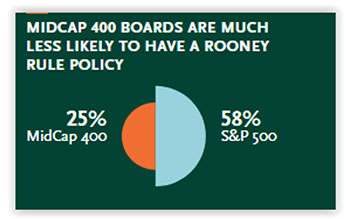

Board diversity mechanisms—Mid-cap boards are much less likely than the S&P 500 to have a Rooney Rule policy or commitment to include diverse candidates in director searches:

In 2025, 43% of new mid-cap directors self-identified as diverse, representing a decline from 60% in 2024 and 63% in 2023. This compares to 46% of new large-cap directors who self-identified as diverse, down from 59% in 2024 and 68% in 2023.

Board evaluations—The percentage of mid-caps conducting annual board evaluations increased from 93% in 2024 to 95% in 2025, trailing the S&P 500’s 99% by a small margin. However, large-caps are much more likely than mid-caps to conduct individual director evaluations, with 48% of large-caps disclosing this practice vs. 23% of mid-caps.