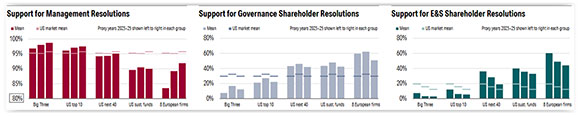

The numerous bar charts in this report from Morningstar illustrate clear variations and patterns and year-over-year trends in voting support for discrete shareholder proposal type by investor group for Morningstar US Large-Mid Cap Index companies for the three proxy years ended June 30, 2025.

For purposes of understanding the data, the “Big Three” refer to BlackRock, State Street, and Vanguard; the “US top 10” include the Big Three as well as Capital Group, Dimensional, Fidelity, Invesco, JP Morgan, Schwab, and T. Rowe Price; and the “US next 40” refers to the next largest US managers of equity and allocation funds for companies in the Index for the three proxy years. As if that weren’t interesting enough, Morningstar also analyzed votes by 601 US sustainable funds and eight European asset managers.

In addition to big picture voting practices and trends, the report includes voting data by asset manager by year and much more granular data, including average support by investor relative to the market mean.