Georgeson’s survey of 134 investment stewardship specialists worldwide at 54 institutional investor firms (representing $60.44 trillion in AUM) revealed these key takeaways, among others:

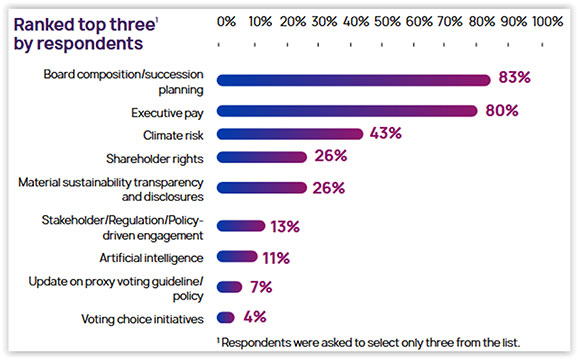

Engagement priorities—Board composition/succession planning topped the list of priorities for 2026, with 61% of respondents ranking these issues as their number one priority and 83% of respondents ranking these topics within the top three, as shown here:

Engagement preferences—Nearly three-quarters of respondents indicated that year-round engagement generates better results than a seasonal focus, while 63% say private dialogue results in a more effective outcome than public campaigns.

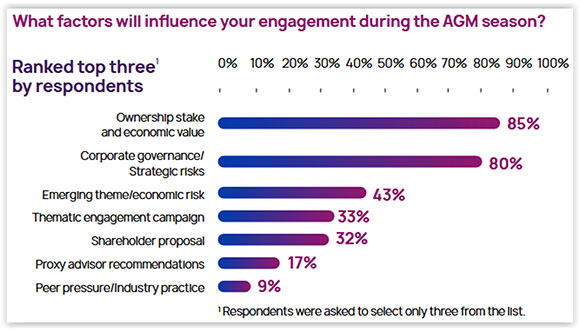

Engagement triggers—A majority of respondents (67%) cited ownership or economic value as the number one reason for investor engagement, while 85% include it among their top three, with governance and strategic risk identified among the top three by 80%:

Activism support—A compelling business strategy is highly likely to influence investors’ decision to support an activist (cited by 87% of investors); however, other factors may also play a role, as depicted here:

Escalation—While less than half (40%) of respondents said that they are more likely to support activist shareholder proposals to achieve their desired outcome if engagement fails, an overwhelming 93% indicated they would be more inclined to vote against the board chair or individual directors, while 94% said they would be more likely to continue to engage with the company, if engagement fails.