"What Directors Think"—from Corporate Board Member and Diligent Institute—reveals the results of a fall 2025 survey of more than 200 US public company directors about upcoming challenges and opportunities in the context of ongoing domestic, geopolitical, and macroeconomic volatility.

Among the key takeaways:

Board agenda—Asked which three topics they would prioritize for their next board meeting agenda, strategic planning led the way, with nearly half (47%) of respondents selecting this topic, followed by AI and other digital / tech risks and opportunities (44%), and M&A opportunities (35%). At the other end of the spectrum: environmental sustainability and third-party risk, each at 1%.

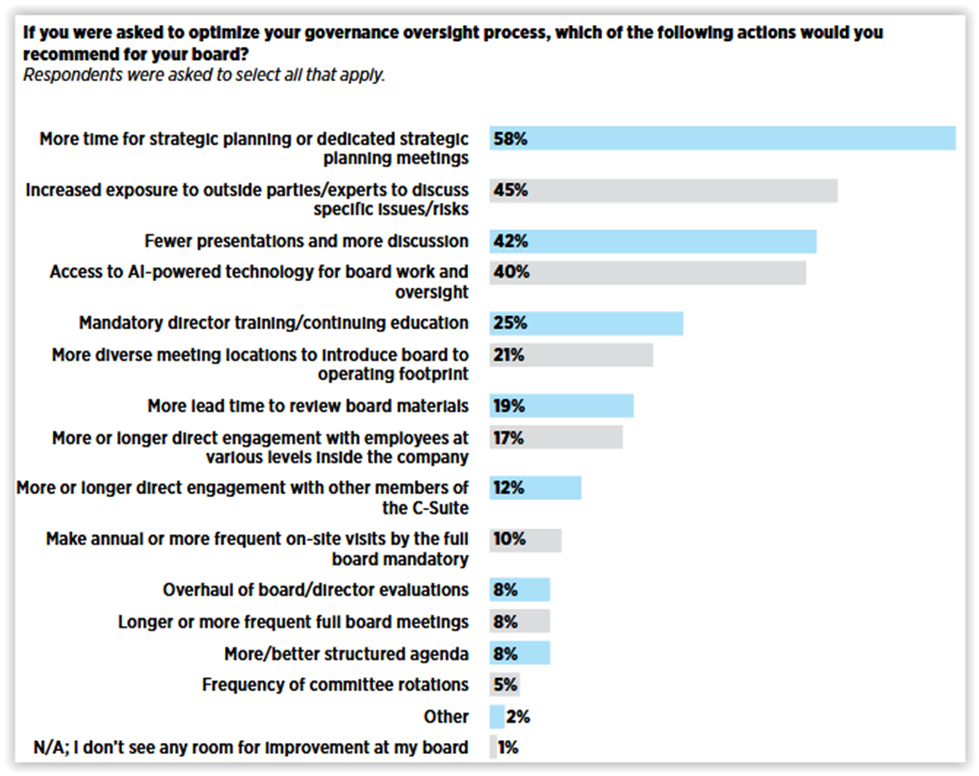

Governance oversight enhancements—Consistent with the foregoing, asked what they would recommend to optimize their board’s governance oversight, most directors would recommend more time or dedicated sessions for strategic planning and many would recommend fewer presentations and more discussion, as detailed here:

Board oversight challenges— Respondents ranked technological developments, including AI (by a wide margin at 40%), followed by innovation / IP (27%), and capital allocation (25%), as the top three issues they find most challenging to oversee in their role as a director today. Bringing up the rear: ESG issues at 2%.

Risk oversight enhancements—Directors most commonly (47%) identified more frequent and structured risk discussions at the full board level as the action item that would most improve their board’s risk oversight, with far fewer directors (19%) looking to add director education and training on emerging risks.

Compliance oversight—Respondents identified management reports and updates as the most valuable data source in facilitating their compliance oversight (58% of respondents), followed by internal audit or risk committee reporting (56%). Asked to select board compliance oversight enhancers, directors noted technology-enabled compliance monitoring tools (39%) and better integration of compliance into strategy discussions (35%), followed by enhanced director education and training (32%).

Use of AI—Only 3% of directors said that AI is fully embedded in their board’s oversight and decision-making process to support its oversight of risks and strategic decision-making, compared to 40% reporting no use by their board in this context.

Board composition—Directors most commonly ranked industry-specific expertise, financial or overall business expertise, and CEO or C-suite experience, as the three most critical attributes for their board’s next new directors (42%, 34%, and 31%, respectively).

See key takeaways online here additional resources on our Board/Governance Practices page.

This post first appeared in the weekly Society Alert!