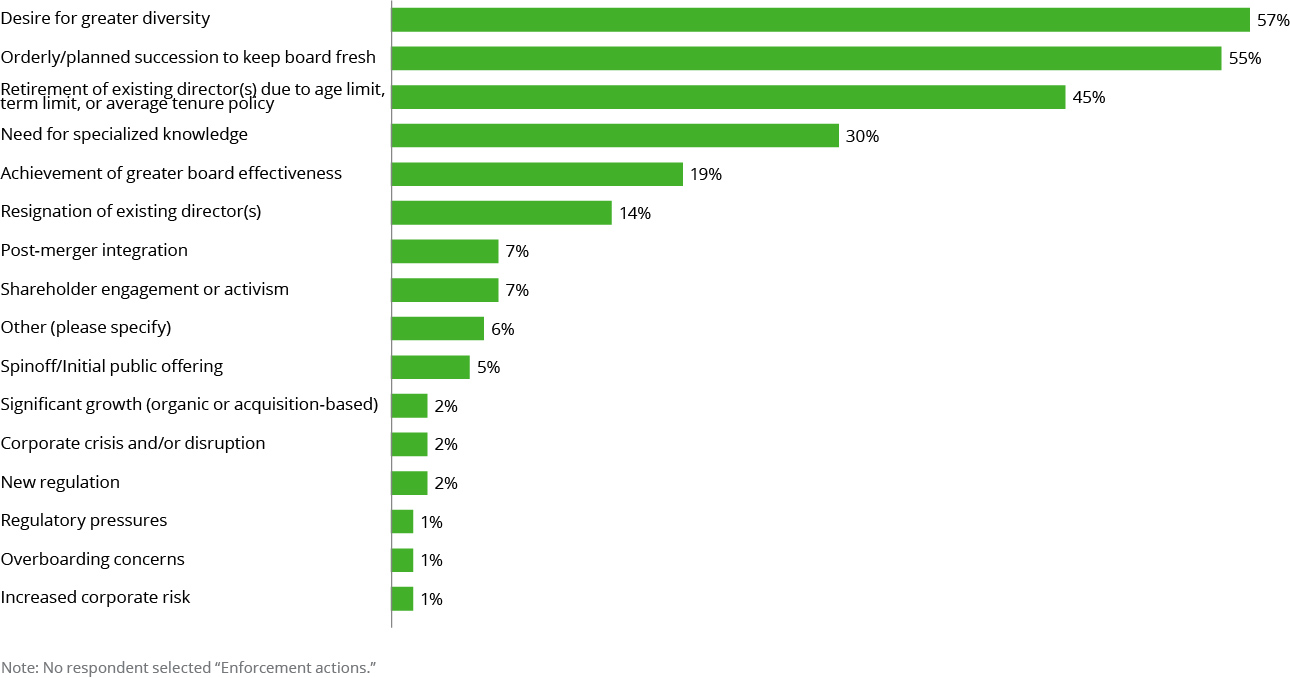

What triggers drove any recent changes in your board composition in the past 1–2 years? Select all that apply.

(105 responses)

A desire for greater diversity was the most commonly cited reason for changes in board composition, followed closely by an orderly/ planned succession to keep the board fresh, at 57% and 55%, respectively. These results differ significantly from a similar question asked in our 2016 board practices survey where the resignation of existing director(s) and retirement of existing director(s) due to age limit policy were the most commonly cited triggers for composition changes (29% and 27%, respectively), followed by orderly/planned succession (22%) and greater diversity (15%).

More large-cap respondents than mid-caps identified achievement of greater board effectiveness as a trigger, at 28% and 8%, respectively. Similarly, more large-caps than mid-caps also reported orderly/planned succession as a trigger, reported by 67% and 46%, respectively.