Nearly two-thirds of the 324 respondents* to the SEC Professionals Group’s recent benchmarking survey characterized their company’s view of ESG reporting as moderately (31%) or very (30%) important, with just 6% describing it as not at all important.

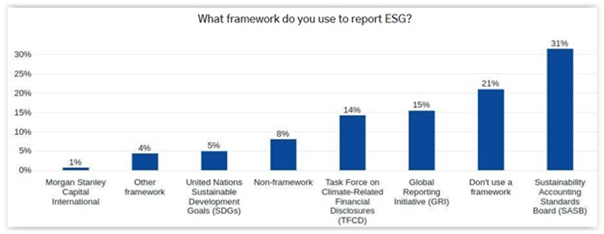

The most common ESG reporting framework is SASB, followed by those who don’t use any framework, as shown here:

Only 8% of respondents said that they don’t report on any ESG topics. The majority of respondents most commonly report on these ESG topics: DE&I (79%), director independence (64%), and compensation policies (53%), with disclosure on other enumerated ESG topics ranging from 3% - 49% of respondents.

Only 8% of respondents said that they don’t report on any ESG topics. The majority of respondents most commonly report on these ESG topics: DE&I (79%), director independence (64%), and compensation policies (53%), with disclosure on other enumerated ESG topics ranging from 3% - 49% of respondents.

*The vast majority of respondents were Accounting & Finance professionals and CPAs representing U.S. public companies across a wide variety of industries. Two-thirds of companies represented by respondents were large accelerated filers and the majority had market caps greater than $4 billion.

See the release and additional resources on our Sustainability page.

This post first appeared in the weekly Society Alert!