EY’s “How committees are evolving to meet changing oversight needs” provides much sought-after benchmarking data on S&P 500 board committee structures and remits based on 2022 proxy statement disclosures and as compared to 2019.

Board committee structure

Three-quarters of companies have at least one standing board committee in addition to the three key committees. This bar chart shows the prevalence of additional board committees:

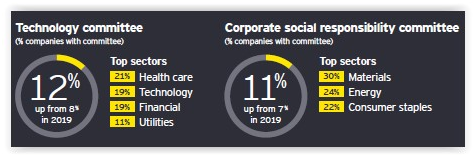

Notably, the percentage of boards with a standalone technology committee (often including responsibility for strategic opportunities, in addition to cyber oversight) increased from 8% in 2019 to 12% in 2022; this committee is most common at Health Care, Technology, and Financial sector companies.

Notably, the percentage of boards with a standalone technology committee (often including responsibility for strategic opportunities, in addition to cyber oversight) increased from 8% in 2019 to 12% in 2022; this committee is most common at Health Care, Technology, and Financial sector companies.

The percentage of boards with a corporate responsibility/sustainability committee (most commonly focused on ESG risks and opportunities, corporate citizenship) increased from 7% in 2019 to 11% in 2022; this committee is most common at Materials, Energy, and Consumer Staples sector companies.

The percentage of boards with a corporate responsibility/sustainability committee (most commonly focused on ESG risks and opportunities, corporate citizenship) increased from 7% in 2019 to 11% in 2022; this committee is most common at Materials, Energy, and Consumer Staples sector companies.

Page 3 of the report portrays the prevalence of the additional standing committees represented in the above bar chart by sector.

Board committee remits

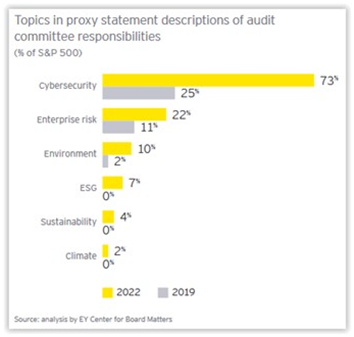

Audit committee—Most notably, audit committee responsibility for cybersecurity increased from 25% of the S&P 500 in 2019 to 73% in 2022.

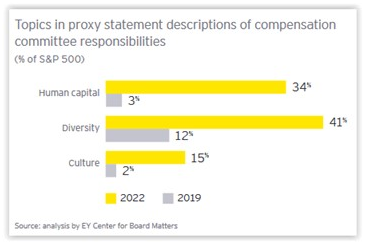

Compensation committee—Compensation committee responsibilities have continued to expand well beyond the traditional executive compensation focus to encompass various broader workforce-related areas, as shown here:

Compensation committee—Compensation committee responsibilities have continued to expand well beyond the traditional executive compensation focus to encompass various broader workforce-related areas, as shown here:

Furthermore, from 2019 to 2022, 33% of compensation committees changed their name to reflect an expanded remit (e.g., “human capital,” “talent,” “human resources”). (See, e.g., our recent report: “Compensation Committee Remit Expands.”)

Furthermore, from 2019 to 2022, 33% of compensation committees changed their name to reflect an expanded remit (e.g., “human capital,” “talent,” “human resources”). (See, e.g., our recent report: “Compensation Committee Remit Expands.”)

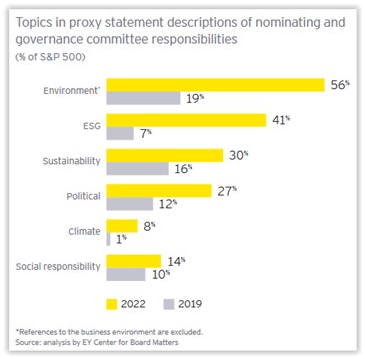

Nominating/governance committee—As has been widely documented, nominating/governance committee responsibilities are commonly being expanded to include primary oversight for ESG-related matters.

However, EY notes that it is frequently observing an integrated approach whereby each standing committee is responsible for oversight of areas of ESG within its purview. (See, e.g., our recent report: “Audit Committee ESG Oversight Responsibilities” and Society/Thompson Hine: “ESG Governance: Board and Management Roles & Responsibilities.”)

However, EY notes that it is frequently observing an integrated approach whereby each standing committee is responsible for oversight of areas of ESG within its purview. (See, e.g., our recent report: “Audit Committee ESG Oversight Responsibilities” and Society/Thompson Hine: “ESG Governance: Board and Management Roles & Responsibilities.”)

The report encourages annual review of the board’s committee structure and responsibilities (as reflected in the committee charters) for potential changes to keep pace with evolving circumstances, which is a “best” governance practice. Considerations and insights relating to this review are outlined on page 7.

See our recent report: “Society Members Speak! Board Committee Practices” and additional resources on our Board Committees page.

This post first appeared in the weekly Society Alert!