A new report from AQTION (complimentary download here) provides noteworthy data on the 65 largest institutional investors’* ESG stewardship practices.

Among the key takeaways:

Proxy advisors

- ISS serves as the “primary” proxy advisor to 50 of the 65 investors, while Glass Lewis serves as primary to nine. However, several investors use both to help inform their proxy voting decision-making.

- The foregoing notwithstanding, a majority of investors exhibit a low level of reliance on the proxy advisors’ recommendations and most have proprietary voting policies.

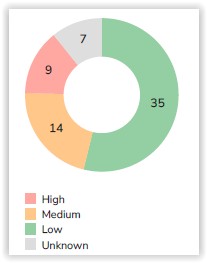

Reliance on the Recommendations of Proxy Advisors

Notably, however, of the 57 investors publicly disclosing a voting policy, just 18 have region-specific guidelines that recognize the significant (in many cases) regulatory and market practice variations across regions.

ESG raters/ratings

Investors most commonly use multiple ESG raters and data providers, with MSCI being used or consulted more than any other provider including Sustainalytics, ISS-ESG, and Bloomberg ESG. Just nine investors don’t use or disclose which ESG Ratings and Research providers they use. Several investors (e.g., State Street, AllianceBernstein, LGIM) also have their own proprietary ESG ratings.

Also included in the report are data on the presence of express voting policies or policy positions on board responsiveness, unequal voting rights, executive compensation, Scope 3 GHG emissions disclosure, political and climate-related lobbying, board and workforce DEI, activism, and other select topics, along with examples of the foregoing, as well as additional benchmarking data .

The authors note the trend toward reduced prescriptiveness and omission of DEI-related expectations in investors’ 2025 voting guidelines seemingly prompted by the US political environment, and the changed shareholder engagement landscape prompted by the recent SEC 13D/G guidance.

* Listed in the Appendix

This post first appeared in the weekly Society Alert!